In the ever-evolving world of finance, businesses are keenly aware of the challenges posed by holding cash reserves when inflation and monetary policies threaten to erode their value. The “Melting Ice Cube Theory,” popularized by MicroStrategy CEO Michael Saylor, provides a compelling analogy for understanding how inflation can slowly diminish the purchasing power of currency, much like an ice cube melting away over time. As businesses, no matter how big or small, grapple with this financial reality, Bitcoin emerges as a viable solution to preserve wealth and enhance treasury strategies.

Understanding the Melting Ice Cube Theory

The Melting Ice Cube Theory describes how holding cash in an environment of persistent inflation results in a slow but steady loss of purchasing power. Central banks, through monetary policies such as quantitative easing and low-interest rates, often increase the money supply to stimulate economic growth. While these actions can buoy markets in the short term, they also lead to currency debasement over time.

Fiat Debasement and Purchasing Power Erosion

1. Historical Context

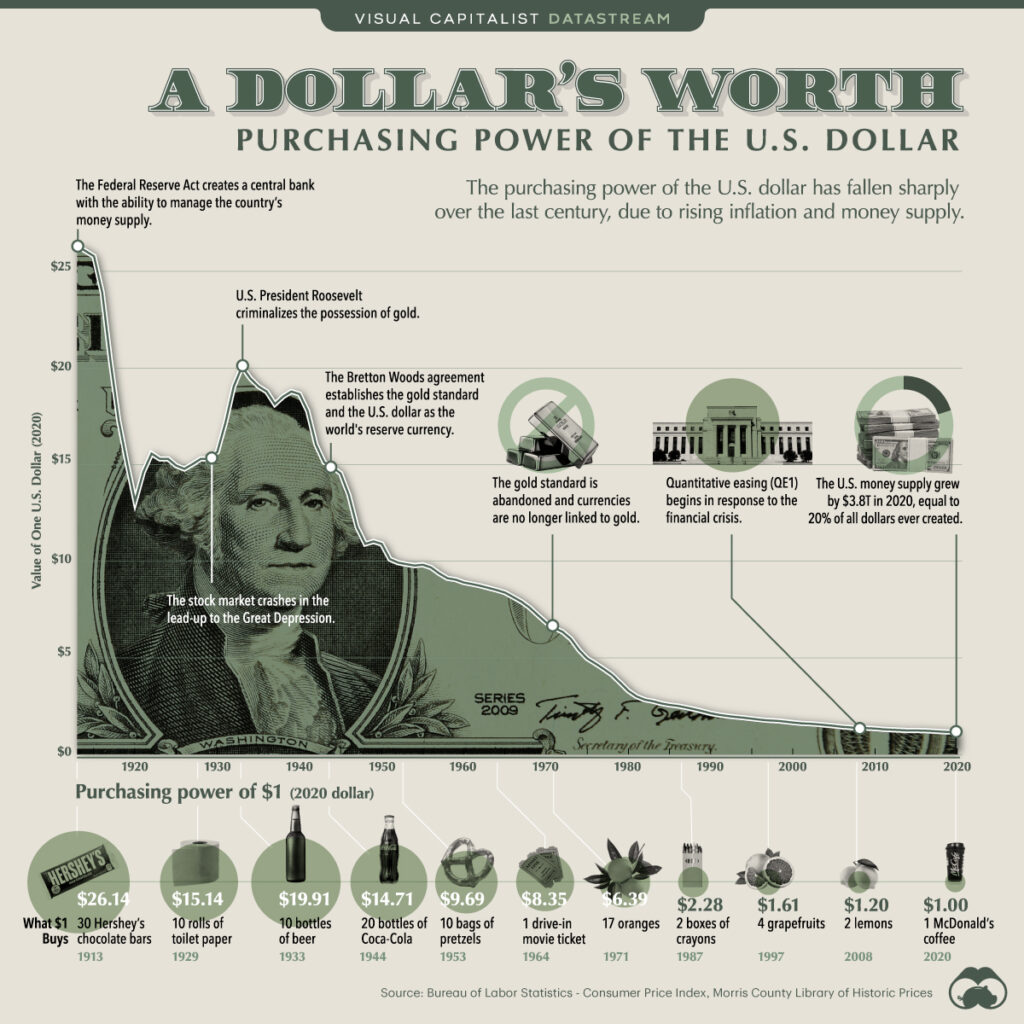

Inflation Rates – Over the decades, inflation has consistently devalued fiat currencies. For instance, in the United States, the dollar has lost over 85% of its purchasing power since the 1970s due to inflation.

Quantitative Easing – In response to economic downturns, central banks have resorted to printing money, further exacerbating the loss of currency value. This was evident during the 2008 financial crisis and the COVID-19 pandemic.

2. Impact on Businesses

Operating Costs – As inflation increases, the cost of goods, services, and operations rise, requiring more cash to maintain the same level of business operations.

Employee Salaries – To keep up with the cost of living, businesses often need to increase employee wages, putting additional pressure on cash reserves.

Case Studies: Successful Adoption of Bitcoin

Some forward-thinking companies have recognized the risks associated with cash reserves and adopted Bitcoin to protect their balance sheets:

1. MicroStrategy

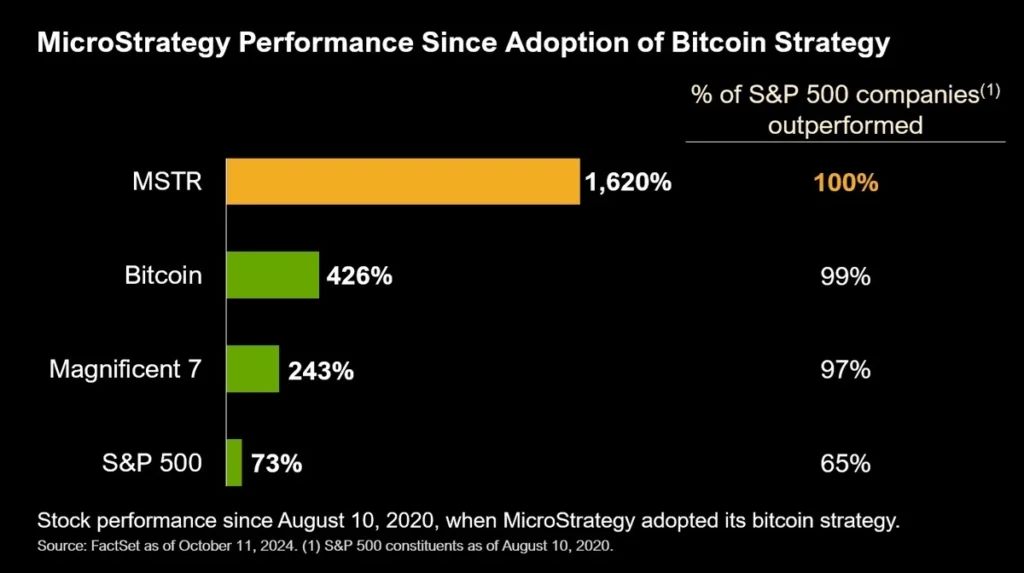

In August 2020, MicroStrategy made a bold move by converting $250 million of its cash reserves into Bitcoin, later investing more than $4 billion in total. This decision was driven by the desire to avoid inflation’s erosion of cash value.

Outcome – MicroStrategy’s stock price and market capitalization significantly increased, driven by the perceived value and foresight of their strategic investment in Bitcoin.

2. Tesla

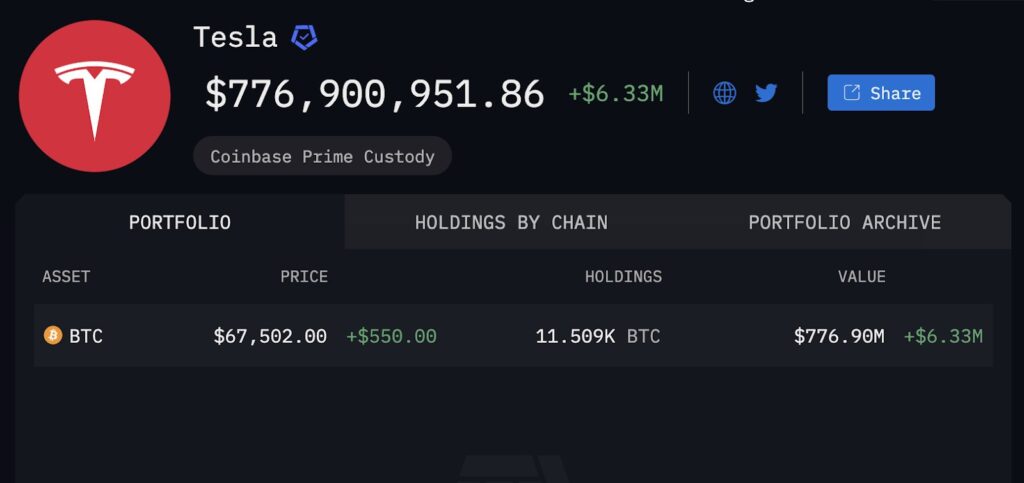

Tesla purchased $1.5 billion worth of Bitcoin in early 2021 as part of its diversified treasury strategy.

Outcome – This investment not only provided Tesla with significant financial gains as Bitcoin prices soared but also enhanced the company’s reputation as an innovative leader in the financial as well as automotive sectors.

3. Square (now Block, Inc.)

Square invested $50 million in Bitcoin in October 2020, viewing the cryptocurrency as a tool to empower economic growth and inclusion.

Outcome – The company’s investment increased in value, and it further invested an additional $170 million, reinforcing its commitment to Bitcoin.

Why Bitcoin is a Strategic Treasury Asset

1. Store of Value

Bitcoin’s finite supply of 21 million coins provides a hedge against inflation, making it resistant to the debasement associated with fiat currencies, which print an unlimited amount of money.

2. Decentralization and Security

As a decentralized digital currency, Bitcoin is less susceptible to government interventions and offers security through blockchain technology.

3. Liquidity and Accessibility

Bitcoin can be easily liquidated when necessary, providing businesses with quick access to funds.

4. Attracting Tech-Savvy Customers

Holding Bitcoin can enhance a company’s brand image by aligning it with technological innovation and future-forward thinking.

5. Ideal for Surplus Cash

Companies with surplus cash that isn’t immediately needed for reinvestment can use Bitcoin to preserve and potentially increase the value of their idle funds.

Conclusion

The Melting Ice Cube Theory underscores the challenges of holding cash in an inflationary economy, prompting businesses to seek alternatives that protect their purchasing power. Bitcoin, with its unique attributes as a decentralized and finite digital asset, offers an effective solution for companies looking to optimize their treasury strategies. By adopting Bitcoin, businesses not only mitigate the risks of fiat debasement but also position themselves at the forefront of financial innovation, ensuring greater economic resilience and growth potential in the years to come.